Flooding can cause significant damage to homes and properties, resulting in substantial financial losses for homeowners. That’s why having flood insurance is crucial. This comprehensive guide will unravel the difference between private flood insurance and the National Flood Insurance Program (NFIP). Understanding the nuances of these two options will help you make an informed decision regarding protecting your property.

Understanding Flood Insurance: An Overview

The Importance of Flood Insurance:

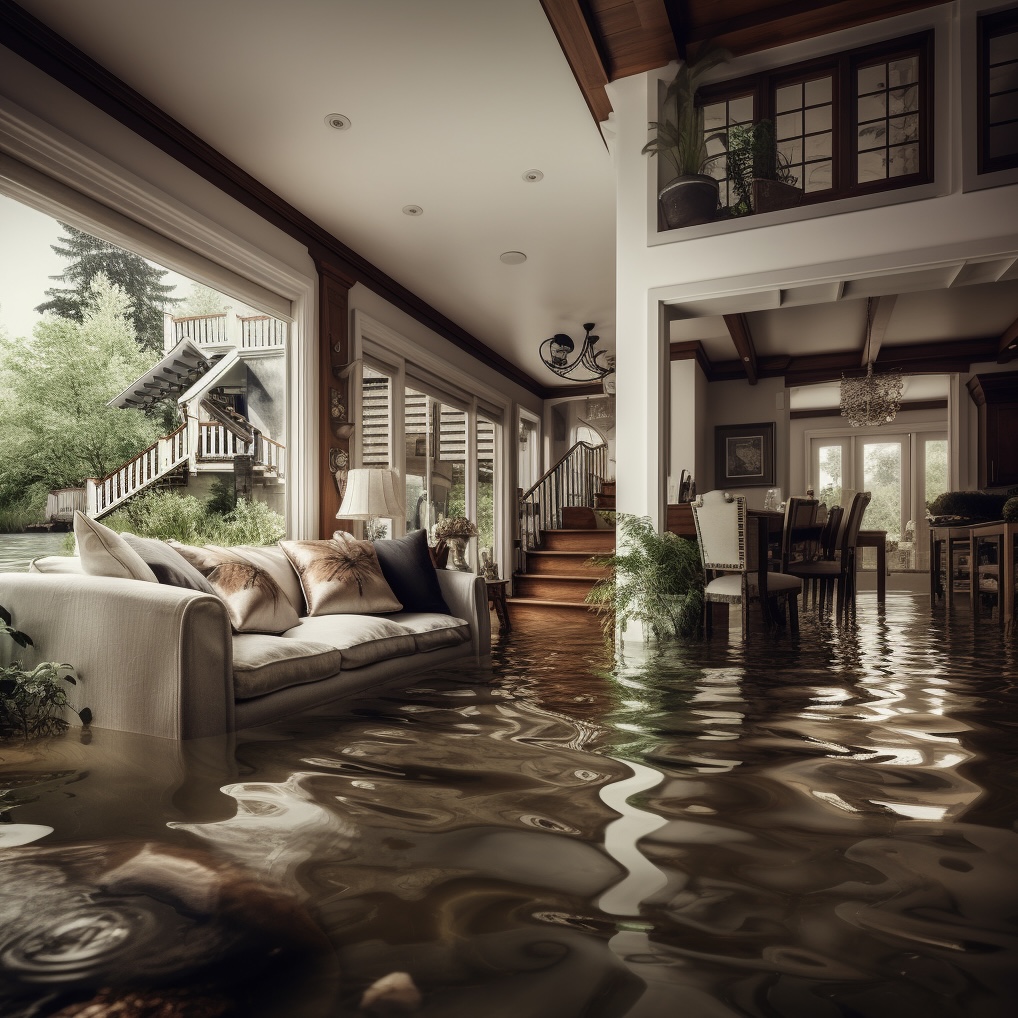

Flooding can occur anywhere, not just in areas prone to hurricanes or near large bodies of water. According to the Federal Emergency Management Agency (FEMA), floods are the number one natural disaster in the United States. Homeowner’s insurance typically does not cover flood damage, so having flood insurance is essential to safeguard your investment.

When it comes to understanding flood insurance, it’s important to recognize the significance it holds in protecting your property. Floods can wreak havoc on homes and businesses, causing extensive damage that can be financially devastating. From structural damage to loss of personal belongings, the aftermath of a flood can be overwhelming.

Types of Flood Insurance:

There are two main types of flood insurance: private flood insurance and the National Flood Insurance Program (NFIP). While both options provide coverage against flood damage, they have critical differences.

Private insurance companies offer flood insurance, often tailored to meet the insured’s specific needs. This type of coverage is not federally regulated and can vary significantly regarding coverage limits, deductibles, and premiums. Private flood insurance may offer more comprehensive coverage options and higher limits than the NFIP.

On the other hand, the National Flood Insurance Program (NFIP) is a federal program administered by FEMA. It was created to provide flood insurance to property owners in communities that participate in the program.

It’s important to carefully evaluate your options and consider your needs when choosing between private flood insurance and the NFIP. Factors such as your property’s location, flood risk, and the value of your assets should all be considered.

Regardless of the type of flood insurance you choose, having this coverage in place can provide peace of mind and financial protection in the event of a flood. It’s crucial to review your policy regularly and make any necessary updates to ensure that your coverage adequately reflects the value of your property and belongings.

Furthermore, understanding the claims process and the steps to take in the aftermath of a flood can help expedite the recovery process. Documenting the damage, contacting your insurance provider promptly, and working with professionals to assess and repair the damage are all essential steps.

Whether you opt for private flood insurance or the NFIP, understanding the different types of coverage available and taking appropriate measures to mitigate flood risks can help safeguard your financial well-being.

What is Private Flood Insurance?

The Basics of Private Flood Insurance:

Private insurance companies offer private flood insurance and provide an alternative to the National Flood Insurance Program (NFIP). While the NFIP is a government-run program, private flood insurance is provided by private companies. This type of insurance typically offers more coverage options and greater policy customization than the NFIP, allowing homeowners to tailor their coverage to their specific needs.

Private insurers also have more flexibility in establishing their rates, which can lead to potential cost savings for homeowners. Private flood insurance companies offer competitive rates to attract customers seeking affordable and comprehensive coverage.

Pros and Cons of Private Flood Insurance:

While the NFIP has coverage limits, private insurers may be able to offer higher limits based on the value of your property and the level of risk associated with it. Knowing their property is adequately protected can give homeowners peace of mind.

In addition to higher coverage limits, private insurers may offer additional coverage options unavailable through the NFIP. For example, some private flood insurance policies may include coverage for temporary living expenses if you are displaced from your home due to flood damage. This can help alleviate the financial burden of finding alternative accommodations while your home is being repaired.

However, it’s important to note that private flood insurance may not be available in all areas. The availability of private coverage depends on various factors, including the level of risk associated with the property and the insurance company’s willingness to provide coverage in that area. Homeowners should check with their insurance agents or explore different insurance providers to determine if private flood insurance is an option.

Another consideration when it comes to private flood insurance is the cost. The cost of private coverage can vary significantly depending on factors such as the location of the property and the level of risk associated with it. In some cases, private flood insurance may be more expensive than the coverage offered through the NFIP. However, weighing the cost against the additional coverage options and customization that private insurance can provide is essential.

In conclusion, private flood insurance offers homeowners an alternative to the NFIP, with more coverage options and policy customization. It can provide higher coverage limits and additional coverage options, but availability and cost can vary depending on location and the risk associated with the property. Homeowners should carefully consider their options and consult with insurance professionals to determine the best flood insurance coverage.

An In-depth Look at the National Flood Insurance Program (NFIP)

The History and Purpose of NFIP:

Established in 1968, the NFIP was created to provide flood insurance to homeowners in high-risk areas who may not be able to obtain coverage through private insurers. FEMA manages the program and aims to reduce the impact of flooding on individuals and communities.

When the NFIP was first established, it responded to the increasing number of flood-related disasters in the United States. The devastating effects of floods on homes and communities highlighted the need for a comprehensive and affordable insurance program. Before the NFIP, many homeowners in flood-prone areas could not secure coverage due to the high risks.

Advantages and Disadvantages of NFIP:

One advantage of the NFIP is its wide availability, as it is offered in participating communities nationwide. This ensures homeowners in high-risk areas can access flood insurance, regardless of location. The program sets standard coverage limits and premiums based on the property’s elevation and flood risk zone. This standardized approach helps simplify the insurance process and ensures that homeowners are adequately protected.

Moreover, the NFIP plays a crucial role in promoting floodplain management. By encouraging communities to implement flood mitigation measures, such as the construction of levees and the establishment of floodplain zoning regulations, the program helps reduce the impact of flooding on individuals and communities. These measures protect homes and properties and save lives by minimizing the risks associated with flooding.

However, the NFIP has faced criticism for its limited coverage options and potential for rate increases. While the program provides a basic level of coverage, it may not fully compensate homeowners for all flood-related damages. Homeowners who require additional coverage may need to seek supplemental insurance from private insurers, which can be costly. Additionally, the NFIP has been known to increase rates periodically, which can pose financial challenges for homeowners already struggling to afford flood insurance.

In conclusion, while the NFIP has made significant strides in providing flood insurance to homeowners in high-risk areas, there are still areas for improvement. Enhancing coverage options, addressing rate increases, and streamlining the claims process are crucial steps toward ensuring that the program effectively serves its purpose of reducing the impact of flooding on individuals and communities.

Comparing Private Flood Insurance and NFIP

Coverage Differences:

When comparing private flood insurance and the NFIP, one key difference lies in the coverage options. Private insurers often offer more extensive coverage options, including additional living expenses and higher coverage limits. This means that with private flood insurance, you can have peace of mind knowing that your property is protected, your personal belongings, and any additional living expenses that may arise due to a flood. On the other hand, the NFIP has more standardized coverage limits, which may not fully meet your specific needs. While it provides coverage for the structure of your property, it may not offer the same level of protection for your personal belongings or provide financial assistance for additional living expenses.

Cost Differences:

The cost of flood insurance can vary depending on several factors, including location, elevation, and the level of risk associated with the property. While private flood insurance rates are influenced by market competition, NFIP premiums are set by the program. Private insurers consider specific risk factors associated with your property, allowing for more personalized pricing. In some cases, private flood insurance may offer more competitive rates, especially if your property is in an area with lower flood risk. However, it’s essential to compare quotes and consider the level of coverage provided. At the same time, private flood insurance may offer lower premiums, but ensuring that the coverage limits and options align with your specific needs and potential risks is vital.

Claim Settlement Differences:

Another significant difference between private flood insurance and the NFIP is the claim settlement process. Private insurers often have more streamlined procedures, processing quicker claims and personalized support. This means you can expect a faster resolution and assistance from your private insurer in flood. They understand the situation’s urgency and aim to provide efficient and effective claims handling. In contrast, the NFIP can experience delays due to the high volume of claims during widespread flooding events. The sheer number of claims can overwhelm the system, resulting in more extended waiting periods for claim settlements. However, it’s important to note that the NFIP is backed by the federal government, providing financial security for policyholders. This means that even though the claim settlement process may take longer, you can have confidence in the financial stability and reliability of the NFIP.

Additional Benefits of Private Flood Insurance:

In addition to the coverage, cost, and claim settlement differences, private flood insurance may offer additional benefits to enhance your overall flood protection. Some private insurers provide proactive risk management services, such as property inspections and recommendations for flood prevention measures. These services can help you minimize the risk of flood damage to your property and potentially reduce your insurance premiums.

Conclusion:

When comparing private flood insurance and the NFIP, it’s important to consider the coverage options, cost differences, and claim settlement processes. Private flood insurance often offers more extensive coverage options, personalized pricing, and quicker claims processing. On the other hand, the NFIP provides standardized coverage limits and financial security backed by the federal government. Choosing between private flood insurance and the NFIP depends on your specific needs, budget, and risk tolerance. It’s recommended to consult with an insurance professional to evaluate your options and make an informed decision.

How to Choose the Right Flood Insurance for You

Factors to Consider When Choosing Flood Insurance:

Several factors should be considered when selecting between private flood insurance and the NFIP. Consider the coverage options, limits, and endorsements available with each option. Evaluate the cost of premiums and compare quotes from multiple insurers. Additionally, assess the financial strength and reputation of the insurer or the backing of the NFIP under FEMA.

Tips for Comparing Insurance Policies:

Reading and understanding the policy documents is essential when comparing flood insurance policies. Pay close attention to the coverage details, exclusions, deductibles, and claim procedures. Take note of any additional endorsements that may be available to enhance coverage. Consider consulting with an insurance professional specializing in flood insurance to ensure you comprehensively understand your options.

In conclusion, understanding the difference between private flood insurance and the NFIP is vital for homeowners seeking protection against flood damage. While private flood insurance offers greater flexibility and coverage options, the NFIP provides wide availability and stability. By considering the specific needs of your property and evaluating the various factors, you can make an informed decision and select the flood insurance policy that best suits your requirements. Don’t leave the protection of your home to chance – invest in flood insurance today.

Contact us today to schedule a consultation and learn more about our comprehensive coverage options.

You can call or text us at 631.517.9211

Interested in learning about homeowners insurance? Check out our article here https://www.soundharborinsurance.com/how-much-home-insurance/